Trending...

- Entering 2026 with Expanding Footprint, Strong Industry Tailwinds, and Anticipated Q3 Results: Off The Hook YS Inc. (N Y S E American: OTH)

- This multi-line slot machine links players to additional games

- myLAB Box Expands, Becoming the First and Only At-Home Testing Company to Serve the Entire Family—Human and Furry—with New Pet Intolerance Test

As the real estate market continues to soar in value, one local real estate broker CEO is worried about a crash on the other side of this hot market. Having lived through the 2008 real estate collapse, Anthony has seen how fast things can turn around and wants to warn homeowners before it's too late.

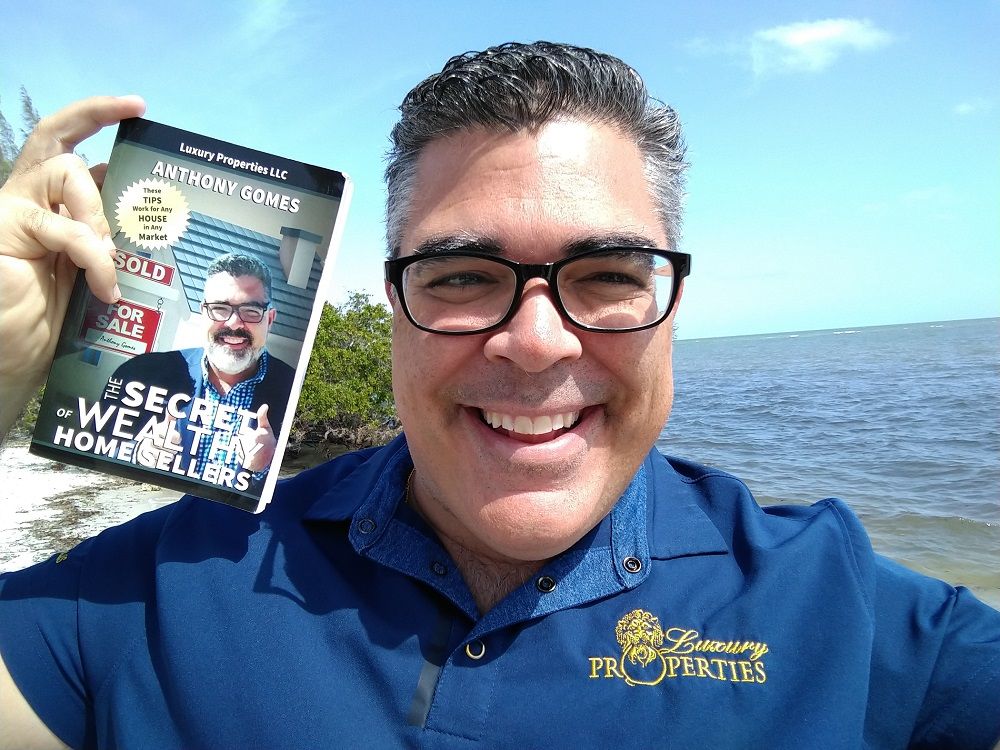

FORT MYERS, Fla. - WisconsinEagle -- If you've followed the Southwest Florida Naples, Cape Coral, and Fort Myers real estate market for a while, you've undoubtedly heard Anthony Gomes, CEO of Luxury Properties on 92.5 Fox News Radio, or even seen him on The News Journal / USA TODAY voted as "The Best Real Estate Broker in Naples and Cape Coral!" With 20 years' experience buying, selling, investing, and brokering real estate you know you are in good hands with his two decades of expertise. He is known as one of the most respected and transparent real estate advisors and brokers in Southwest Florida when it comes to marketing homes to sell for the most amount of money. Today, he wants to warn homeowners that are thinking about selling, that now could be the time. This is especially true if they're behind on their mortgage payments, because this time around unlike 2008 they could end up homeless. And what about the folks that are not behind on their payments? Well, they could lose a lot of equity, making now a good time to either upgrade or downgrade their present home, before all this new inventory comes into the market.

More on Wisconsin Eagle

Almost everyone knows the real estate market is still crazy hot. There is still a significant lack of inventory in the resale and rental markets because tens of millions of people that haven't paid their monthly payments in nearly a year, are still allowed to stay in their residence.

However, the government has stated that it will be lifting the foreclosure moratorium June 30th, which means everyone is going to start having to make their mortgage payments. June is quickly approaching, and the banks are in trouble right now, so they have all of their paperwork ready to immediately file foreclosure on millions of properties, the very day they are allowed to.

When we asked Anthony, how is this different than the last real estate market crash? He responded "During the last crash, it made sense to stay in your home as long as you could because the homes didn't have equity, they were upside down in value and it didn't cost you much to stay in your home. So, you could ride it out staying there until you went to foreclosure, and the lender took the house. Now it's different, these homes all have large amounts of equity in them, and the banks know this, and they want that equity so they're not going to be slow this time around. The time to sell is now for these folks, even though they have missed multiple payments, they could still sell right now and walk away with a big fat check. And that's even after paying late fees, late payments and more. They need to be warned though, that as soon as the foreclosure is filed, things will drastically change for them. Their foreclosure filing expenses will skyrocket, the attorney fees, and court costs could add up to thousands of dollars which means it will eat into the equity they currently have. That means they cannot collect a big fat check and now their credit rating is going to nosedive, which means they will struggle to secure other living arrangements. We could have a really big homeless problem on our hands if folks don't take action and sell their homes. Now is their best chance to sell and walk away with a lump sum of money and a better credit rating than if they have a foreclosure which will haunt them for years to come. For folks that are not behind on their payments but have thought about selling, they need to act fast All of this foreclosure inventory coming will plummet their home's value, so if they've wanted to upgrade or downgrade, now is the time."

More on Wisconsin Eagle

It's also true that homes may never be worth what they are today, and your equity position may never be higher than it is today, before the flood of foreclosure homes hit the market this coming summer. So, you should consider your options now just in case things do change for the worse.

About Anthony Gomes:

For more information on how to prepare for what is coming, Anthony is available for a free, no obligation, no pressure consultation with you and your family so you can intelligently weigh your options, Contact Anthony Gomes at his office by calling 239-308-5818 and one of his assistants will answer and make arrangements to meet with Anthony. You can also visit his website https://www.SouthwestFloridaRealEstateListings.com

More on Wisconsin Eagle

- MEX Finance meluncurkan platform keuangan berbasis riset yang berfokus pada data, logika, dan efisiensi pengambilan keputusan investasi

- From MelaMed Wellness to Calmly Rooted: A New Chapter in Functional Wellness

- New Angles US Group Founder Alexander Harrington Receives Top U.S. Corporate Training Honor and Leads Asia-Pacific Engagements in Taiwan

- UK Financial Ltd Board of Directors Establishes Official News Distribution Framework and Issues Governance Decision on Official Telegram Channels

- UK Financial Ltd Sets Official 30-Day Conversion Deadline for Three Exchange Listed Tokens Ahead of Regulated Upgrade

Almost everyone knows the real estate market is still crazy hot. There is still a significant lack of inventory in the resale and rental markets because tens of millions of people that haven't paid their monthly payments in nearly a year, are still allowed to stay in their residence.

However, the government has stated that it will be lifting the foreclosure moratorium June 30th, which means everyone is going to start having to make their mortgage payments. June is quickly approaching, and the banks are in trouble right now, so they have all of their paperwork ready to immediately file foreclosure on millions of properties, the very day they are allowed to.

When we asked Anthony, how is this different than the last real estate market crash? He responded "During the last crash, it made sense to stay in your home as long as you could because the homes didn't have equity, they were upside down in value and it didn't cost you much to stay in your home. So, you could ride it out staying there until you went to foreclosure, and the lender took the house. Now it's different, these homes all have large amounts of equity in them, and the banks know this, and they want that equity so they're not going to be slow this time around. The time to sell is now for these folks, even though they have missed multiple payments, they could still sell right now and walk away with a big fat check. And that's even after paying late fees, late payments and more. They need to be warned though, that as soon as the foreclosure is filed, things will drastically change for them. Their foreclosure filing expenses will skyrocket, the attorney fees, and court costs could add up to thousands of dollars which means it will eat into the equity they currently have. That means they cannot collect a big fat check and now their credit rating is going to nosedive, which means they will struggle to secure other living arrangements. We could have a really big homeless problem on our hands if folks don't take action and sell their homes. Now is their best chance to sell and walk away with a lump sum of money and a better credit rating than if they have a foreclosure which will haunt them for years to come. For folks that are not behind on their payments but have thought about selling, they need to act fast All of this foreclosure inventory coming will plummet their home's value, so if they've wanted to upgrade or downgrade, now is the time."

More on Wisconsin Eagle

- New Jersey Therapy and Life Coaching Unveils Original Dan Fenelon Mural in Voorhees New Jersey Therapy Office

- Kentucky Judges Ignore Evidence, Prolong Father's Ordeal in Baseless Case

- Contracting Resources Group Receives 2025 HIRE Vets Platinum Medallion Award from the U.S. Department of Labor

- Crunchbase Ranks Phinge Founder & CEO Robert DeMaio #1 Globally. Meet him in Las Vegas-Week of CES to Learn About Netverse, Patented App-less Platform

- IODefi Introduces New Web3 Infrastructure Framework as XRP Ledger Development Gains Global Attention

It's also true that homes may never be worth what they are today, and your equity position may never be higher than it is today, before the flood of foreclosure homes hit the market this coming summer. So, you should consider your options now just in case things do change for the worse.

About Anthony Gomes:

For more information on how to prepare for what is coming, Anthony is available for a free, no obligation, no pressure consultation with you and your family so you can intelligently weigh your options, Contact Anthony Gomes at his office by calling 239-308-5818 and one of his assistants will answer and make arrangements to meet with Anthony. You can also visit his website https://www.SouthwestFloridaRealEstateListings.com

Source: Luxury Properties LLC

0 Comments

Latest on Wisconsin Eagle

- London Art Exchange Emerges as a Leading Force in UK Contemporary Art, Elevating Three Artists to Secondary-Market Success

- myLAB Box Expands, Becoming the First and Only At-Home Testing Company to Serve the Entire Family—Human and Furry—with New Pet Intolerance Test

- This multi-line slot machine links players to additional games

- Entering 2026 with Expanding Footprint, Strong Industry Tailwinds, and Anticipated Q3 Results: Off The Hook YS Inc. (N Y S E American: OTH)

- Tiger-Rock Martial Arts Appoints Jami Bond as Vice President of Growth

- Super League (N A S D A Q: SLE) Enters Breakout Phase: New Partnerships, Zero Debt & $20 Million Growth Capital Position Company for 2026 Acceleration

- Finland's Gambling Reform Promises "Single-Click" Block for All Licensed Sites

- Private Keys Are a Single Point of Failure: Security Advisor Gideon Cohen Warns MPC Technology Is Now the Only Defense for Institutional Custody

- Compliance Is the Ticket to Entry: Legal Advisor Gabriela Moraes Analyzes RWA Securitization Paths Under Brazil's New Legislation

- Coalition and CCHR Call on FDA to Review Electroshock Device and Consider a Ban

- Spark Announces 2025 Design Award Winners

- NEW Luxury Single-Family Homes Coming Soon to Manalapan - Pre-Qualify Today for Priority Appointments

- Dominic Pace Returns to the NCIS Franchise With Guest Role on NCIS: Origins

- Anderson Periodontal Wellness Attends 5th Joint Congress for Ceramic Implantology

- UK Financial Ltd Completes Full Ecosystem Conversion With Three New ERC-3643 SEC-Ready Tokens As MCAT Deadline Closes Tonight

- AI Real Estate Company Quietly Building a National Powerhouse: reAlpha Tech Corp. (N A S D A Q: AIRE)

- Inkdnylon Expands National Uniform Embroidery Services

- Appliance EMT Expands Appliance Repair Services to Portland, OR and Vancouver, WA

- Next Week: The World's Best Young Pianists Arrive in Music City for the 2025 Nashville International Chopin Piano Competition

- Revenue Optics Builds Out Its Dedicated Sales Recruiting Firm with Strategic Addition of Christine Schafer