Trending...

- Entering 2026 with Expanding Footprint, Strong Industry Tailwinds, and Anticipated Q3 Results: Off The Hook YS Inc. (N Y S E American: OTH)

- myLAB Box Expands, Becoming the First and Only At-Home Testing Company to Serve the Entire Family—Human and Furry—with New Pet Intolerance Test

- This multi-line slot machine links players to additional games

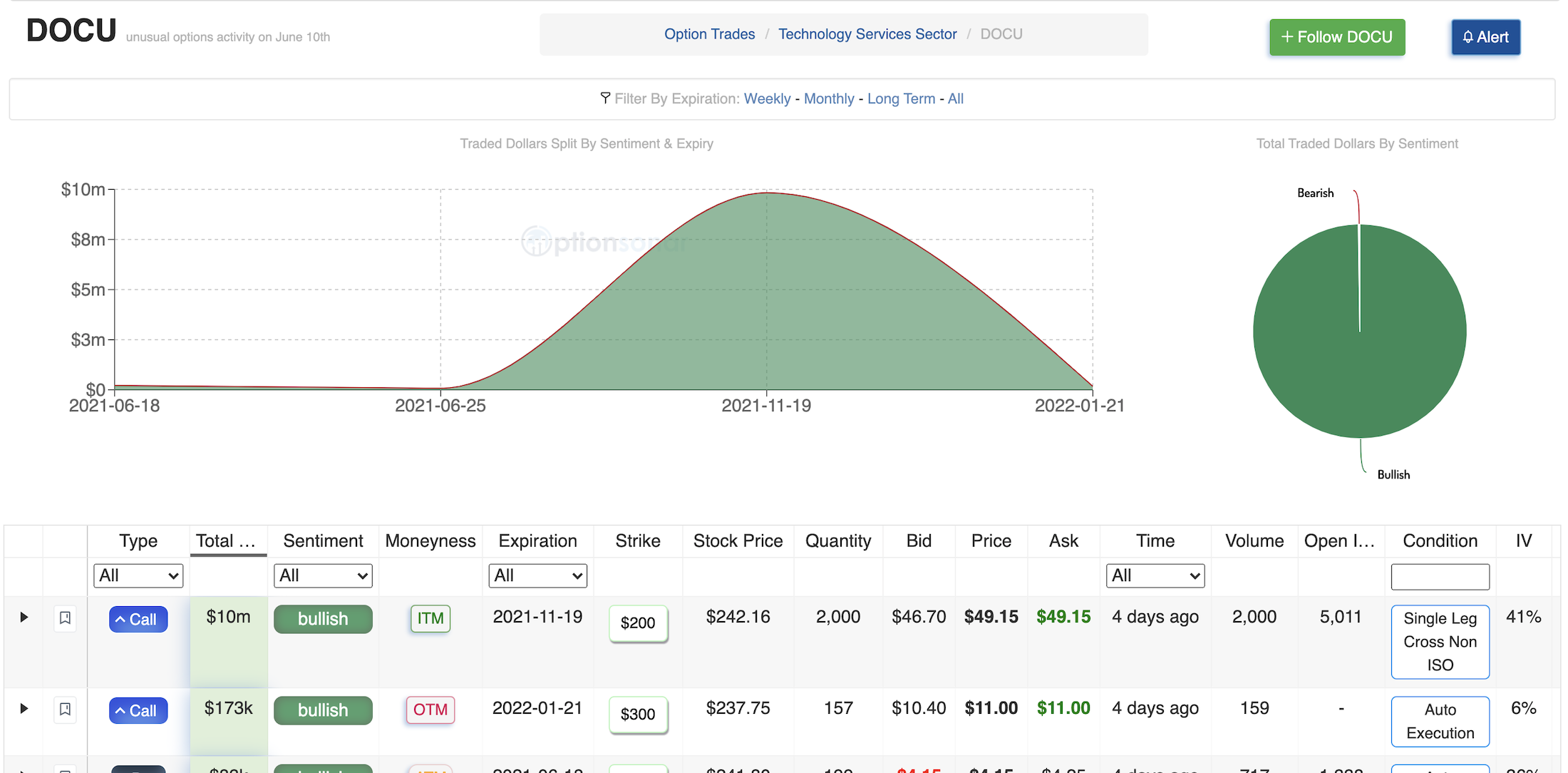

SAN FRANCISCO - WisconsinEagle -- Stock of the software as a service company Docusign captured large in the money call stock options expiring at the end of the year. Traders often use in the money stock options as a leveraged way to expose themselves to the underlying stock. They are often referred as stock replacement trades as they require less capital to put on but are subject to directional risk just as if you were owning the underlying equity directly. This particular trader is betting over $10 million that the stock price of Docusign stock will at least be $200 by the end of the year.

View the latest unusual options activity for Docusign stock

Why are options such an important indicator for future stock price movements?

Even though options have traditionally been thought of as a hedging instrument, often times due to the amount of leverage they are also used by large institutional buyers to capitalize on large impeding stock movements.

More on Wisconsin Eagle

What is unusual option activity?

Millions of options trades exchange hands every day. Not all of them are made equally, that's for sure. Some carry more information than others. Unusual option trades are that type of option trade.

Unusual options activity is defined as a single trade that is bought on the ask or sold on the bid, with unusual volume and/or trade size compared to the open interest for that particular strike and expiry. This means that these are new contracts being traded, expressing a fresh opinion on the underlying stock.

Why is this interesting? Well given a large enough trade and it being bought on the ask or sold on the bid it shows extreme urgency on the trader's side.

For example, let's look at a trade of 5,000 calls which had a bid and ask spread of $3.00 by $3.70 respectively, and the order was executed on the ask at $3.70.

More on Wisconsin Eagle

What does that tell us?

The trader bought 5,000 call contracts, dropping $1.8M on the trade. Now, if they were patient and waited to fill the order in the middle of the bid and ask spread, say $3.35, they could have saved potentially $175K, but they didn't. To me, that says they have high expectations for this trade, and saving $175K is chump change.

This paired with the unusual high daily volume and size of the trade makes this type of trade very interesting, carrying a signal that there is a likelihood of a potential large move in the underlying stock. Unusually large purchases of options contracts indicate that someone thinks there is an impending event that will move a stock in a big way.

Optionsonar makes it very easy to stay in the loop on the latest unusual options activity by using a proprietary algorithm that was once only available to institutional traders on Wall Street.

View the latest unusual options activity for Docusign stock

Why are options such an important indicator for future stock price movements?

Even though options have traditionally been thought of as a hedging instrument, often times due to the amount of leverage they are also used by large institutional buyers to capitalize on large impeding stock movements.

More on Wisconsin Eagle

- Holiday Decorations Most Likely to Cause Injuries

- UK Financial Ltd Confirms Official Corporate Structure of the Maya Preferred Project and Its Dual-Class Token System

- CCHR Florida Joins Global Call to Ban Electroshock Treatment, Citing New Evidence of Widespread Patient Harm

- BoxingRx Announces Full Gym Renovation Ahead of New Ownership's One-Year Anniversary

- UK Financial Ltd Announces It's Official Corporate Headquarters In The United Kingdom

What is unusual option activity?

Millions of options trades exchange hands every day. Not all of them are made equally, that's for sure. Some carry more information than others. Unusual option trades are that type of option trade.

Unusual options activity is defined as a single trade that is bought on the ask or sold on the bid, with unusual volume and/or trade size compared to the open interest for that particular strike and expiry. This means that these are new contracts being traded, expressing a fresh opinion on the underlying stock.

Why is this interesting? Well given a large enough trade and it being bought on the ask or sold on the bid it shows extreme urgency on the trader's side.

For example, let's look at a trade of 5,000 calls which had a bid and ask spread of $3.00 by $3.70 respectively, and the order was executed on the ask at $3.70.

More on Wisconsin Eagle

- Rigani Press Announces Breakthrough Book for Health IT and Medical Leaders to Forge the Road to Responsible AI

- FreeTo.Chat - The bold, Anonymous Confession Platform, ushers in a new era of tension relief

- Hyatt House Fresno Celebrates Grand Opening, Introducing the First Hyatt House in Fresno, California

- "I Make Music Not Excuses" Journal by Anthony Clint Jr. Becomes International Amazon Best Seller, Empowering Music Creators Worldwide

- DanReDev, Kaufman Development & Oldivai Announce Major 2026 Projects Nationwide

What does that tell us?

The trader bought 5,000 call contracts, dropping $1.8M on the trade. Now, if they were patient and waited to fill the order in the middle of the bid and ask spread, say $3.35, they could have saved potentially $175K, but they didn't. To me, that says they have high expectations for this trade, and saving $175K is chump change.

This paired with the unusual high daily volume and size of the trade makes this type of trade very interesting, carrying a signal that there is a likelihood of a potential large move in the underlying stock. Unusually large purchases of options contracts indicate that someone thinks there is an impending event that will move a stock in a big way.

Optionsonar makes it very easy to stay in the loop on the latest unusual options activity by using a proprietary algorithm that was once only available to institutional traders on Wall Street.

Source: Optionsonar

0 Comments

Latest on Wisconsin Eagle

- Anderson Periodontal Wellness Attends 5th Joint Congress for Ceramic Implantology

- UK Financial Ltd Completes Full Ecosystem Conversion With Three New ERC-3643 SEC-Ready Tokens As MCAT Deadline Closes Tonight

- AI Real Estate Company Quietly Building a National Powerhouse: reAlpha Tech Corp. (N A S D A Q: AIRE)

- Inkdnylon Expands National Uniform Embroidery Services

- Appliance EMT Expands Appliance Repair Services to Portland, OR and Vancouver, WA

- Next Week: The World's Best Young Pianists Arrive in Music City for the 2025 Nashville International Chopin Piano Competition

- Revenue Optics Builds Out Its Dedicated Sales Recruiting Firm with Strategic Addition of Christine Schafer

- Hydrofast Elevates the Holiday Season: The C100 Countertop RO System Merges Smart Tech with Wellness for the Perfect Christmas Gift

- Madison: Make Sure Your Home is Winter Ready!

- Madison: South Point and Sycamore Drop-off Sites Begin Winter Hours on December 5, 2025

- Melospeech Inc. Accepts Nomination for HealthTech Startup of the Year

- Flower City Tattoo Convention Draws Record Attendance in Rochester, NY

- KIKO NATION TOKEN (Official Release)

- Starlink Local Installers helping Wisconsin stay wired

- Verb™ Presents Features Vanguard Personalized Indexing: Utilizing Advanced Tax-Loss Harvesting Technology

- UK Financial Ltd Announces A Special Board Meeting Today At 4PM: Orders MCAT Lock on CATEX, Adopts ERC-3643 Standard, & Cancels $0.20 MCOIN for $1

- 6 Holiday Looks That Scream "Old Money" But Cost Less Than Your Christmas Tree

- From Cheer to Courtroom: The Hidden Legal Risks in Your Holiday Eggnog

- Controversial Vegan Turns Rapper Launches First Song, "Psychopathic Tendencies."

- Inside the Fight for Affordable Housing: Avery Headley Joins Terran Lamp for a Candid Bronx Leadership Conversation