Trending...

- Yoga Retreats, Ecstatic Dance & Spiritual App launched

- Madison: Women in Construction Profile 2026: Laura Amundson

- Sellvia Market Expands Curated Store Portfolio for Dropshipping Sellers

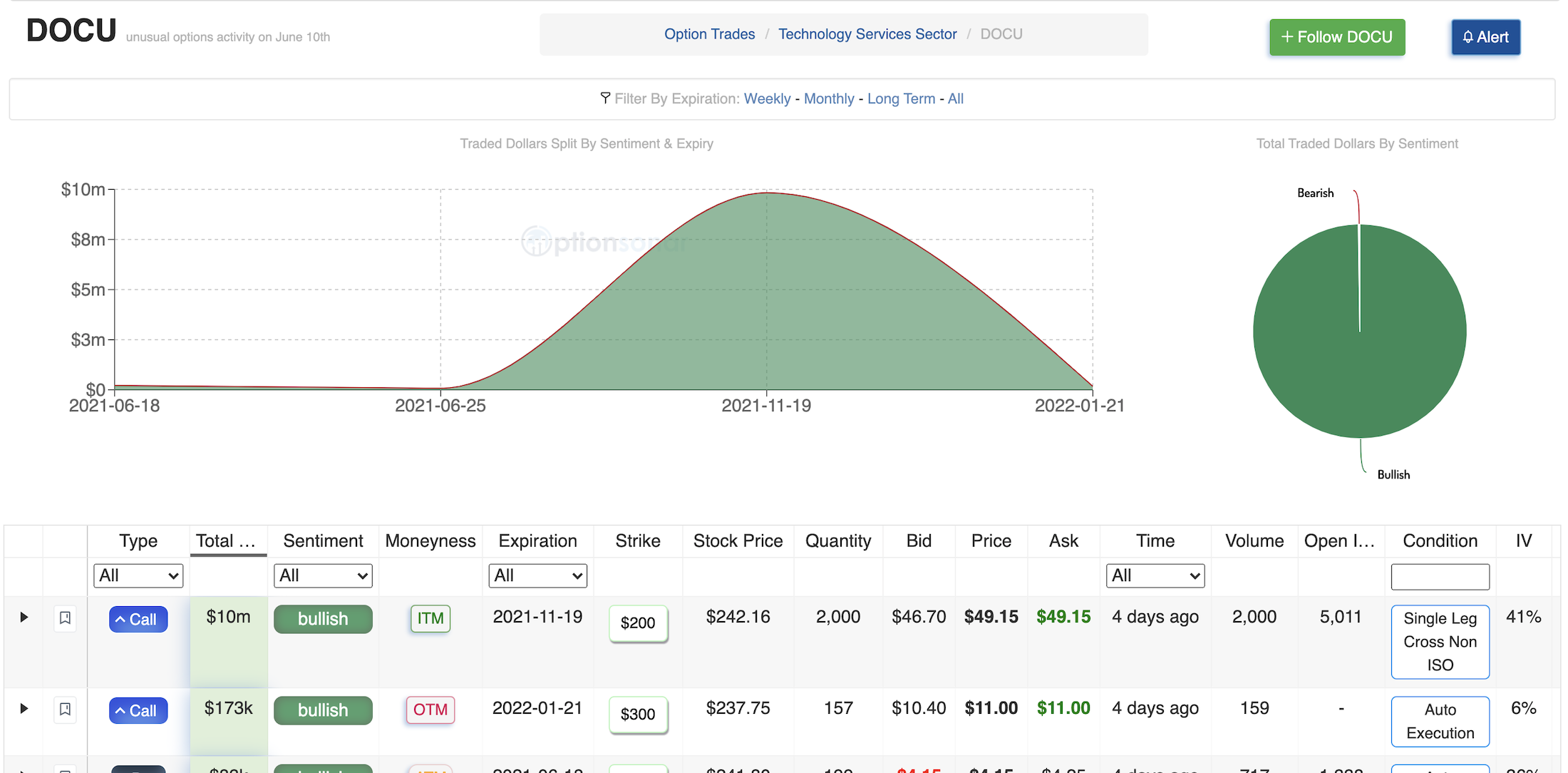

SAN FRANCISCO - WisconsinEagle -- Stock of the software as a service company Docusign captured large in the money call stock options expiring at the end of the year. Traders often use in the money stock options as a leveraged way to expose themselves to the underlying stock. They are often referred as stock replacement trades as they require less capital to put on but are subject to directional risk just as if you were owning the underlying equity directly. This particular trader is betting over $10 million that the stock price of Docusign stock will at least be $200 by the end of the year.

View the latest unusual options activity for Docusign stock

Why are options such an important indicator for future stock price movements?

Even though options have traditionally been thought of as a hedging instrument, often times due to the amount of leverage they are also used by large institutional buyers to capitalize on large impeding stock movements.

More on Wisconsin Eagle

What is unusual option activity?

Millions of options trades exchange hands every day. Not all of them are made equally, that's for sure. Some carry more information than others. Unusual option trades are that type of option trade.

Unusual options activity is defined as a single trade that is bought on the ask or sold on the bid, with unusual volume and/or trade size compared to the open interest for that particular strike and expiry. This means that these are new contracts being traded, expressing a fresh opinion on the underlying stock.

Why is this interesting? Well given a large enough trade and it being bought on the ask or sold on the bid it shows extreme urgency on the trader's side.

For example, let's look at a trade of 5,000 calls which had a bid and ask spread of $3.00 by $3.70 respectively, and the order was executed on the ask at $3.70.

More on Wisconsin Eagle

What does that tell us?

The trader bought 5,000 call contracts, dropping $1.8M on the trade. Now, if they were patient and waited to fill the order in the middle of the bid and ask spread, say $3.35, they could have saved potentially $175K, but they didn't. To me, that says they have high expectations for this trade, and saving $175K is chump change.

This paired with the unusual high daily volume and size of the trade makes this type of trade very interesting, carrying a signal that there is a likelihood of a potential large move in the underlying stock. Unusually large purchases of options contracts indicate that someone thinks there is an impending event that will move a stock in a big way.

Optionsonar makes it very easy to stay in the loop on the latest unusual options activity by using a proprietary algorithm that was once only available to institutional traders on Wall Street.

View the latest unusual options activity for Docusign stock

Why are options such an important indicator for future stock price movements?

Even though options have traditionally been thought of as a hedging instrument, often times due to the amount of leverage they are also used by large institutional buyers to capitalize on large impeding stock movements.

More on Wisconsin Eagle

- TUMN Exposes the Psychological Impact of High-Control Religion: Breaking the Spiritual Faraday Cage

- Pastor Saeed Abedini Releases THE TRUTH – Volume 1, A Deeply Personal Story of Faith, Struggle, and Redemption

- New Book Warring From the Standpoint of the Throne Room Calls Believers to Pray From Victory

- Sun Vault Roofing Named CertainTeed SolarMaster Pro Contractor

- Scotch Whisky Market Dislocation Creates Compelling Entry Opportunity for Long-Term Investors

What is unusual option activity?

Millions of options trades exchange hands every day. Not all of them are made equally, that's for sure. Some carry more information than others. Unusual option trades are that type of option trade.

Unusual options activity is defined as a single trade that is bought on the ask or sold on the bid, with unusual volume and/or trade size compared to the open interest for that particular strike and expiry. This means that these are new contracts being traded, expressing a fresh opinion on the underlying stock.

Why is this interesting? Well given a large enough trade and it being bought on the ask or sold on the bid it shows extreme urgency on the trader's side.

For example, let's look at a trade of 5,000 calls which had a bid and ask spread of $3.00 by $3.70 respectively, and the order was executed on the ask at $3.70.

More on Wisconsin Eagle

- Peccioli Becomes New Orleans: In July 2026, the magic of jazz comes to Tuscany

- $6 Million Funding Secured as Retail Expansion, Operational Streamlining, and Asset-Light Strategy Position the Company for Accelerated Growth $SOWG

- The "Unsexy" Business Quietly Creating 130+ New Entrepreneurs Across America — From Alaska to Puerto Rico

- Veteran Launches GTG Energy: Nicotine-Free Pouch as Americans Rethink Addiction, Focus, and What Fuels Performance

- Growth Isn't Optional—It's Essential: LaTasha Langdon Launches a Game-Changing Resource

What does that tell us?

The trader bought 5,000 call contracts, dropping $1.8M on the trade. Now, if they were patient and waited to fill the order in the middle of the bid and ask spread, say $3.35, they could have saved potentially $175K, but they didn't. To me, that says they have high expectations for this trade, and saving $175K is chump change.

This paired with the unusual high daily volume and size of the trade makes this type of trade very interesting, carrying a signal that there is a likelihood of a potential large move in the underlying stock. Unusually large purchases of options contracts indicate that someone thinks there is an impending event that will move a stock in a big way.

Optionsonar makes it very easy to stay in the loop on the latest unusual options activity by using a proprietary algorithm that was once only available to institutional traders on Wall Street.

Source: Optionsonar

0 Comments

Latest on Wisconsin Eagle

- Building a Multi-Domain Autonomous Systems Platform at the Intersection of AI, Defense and Infrastructure: VisionWave Holdings (N A S D A Q: VWAV)

- Bent Danholm Named "Top Luxury Real Estate Leader" in Modern Luxury Miami

- Author Ken Mora to Celebrate New Caravaggio Book Debut with Special Event at Palazzo Venezia Naples

- Matthew Sisneros Releases Raw and Unfiltered Memoir: The Devil Lost Another One — A Powerful Story of Crime, Consequence, and Redemption

- From Life to Light: Jess L. Martinez Shares a Soulful Poetry Collection That Explores What It Means to Be Human

- Lawsuit Filed Against Boeing Over Defective Seat Switch on Boeing 787

- Quadcode Acquires Significant Stake in Game 7, LLC - The Parent Company for FPFX Tech and PropAccount.com

- Capital Is Never "Free" - HCC Announces Educational Webinar on Capital Alignment March 19

- Danholm Collection Announces Sale of 16689 Broadwater Ave in Winter Garden, Highlighting Strong Performance in Twinwaters Community

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

- Raleigh Emerges as a Key Player in Sustainable Fashion Innovation for 2026

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Madison: Women in Construction Profile 2026: Laura Amundson

- Madison: Absentee Ballots Arriving Earlier for Dane County Voters

- Madison: Reimagining and Reinvesting in Odana Hills Golf Course

- Madison: Rainy Friday, Urban Flash Flooding Possible Thanks to Frost