Trending...

- Lick Personal Oils Introduces the Ultimate Valentine's Day Gift Collection for Romantic, Thoughtful Gifting

- The New Monaco of the South (of Italy)

- FrostSkin Launches Kickstarter Campaign for Patent-Pending Instant-Chill Water Purification Bottle

$100 Million in Listings and $35 Million Closed: Off The Hook YS (N Y S E American: OTH) $OTH Accelerates into Luxury Yachting with Autograph Yacht Group

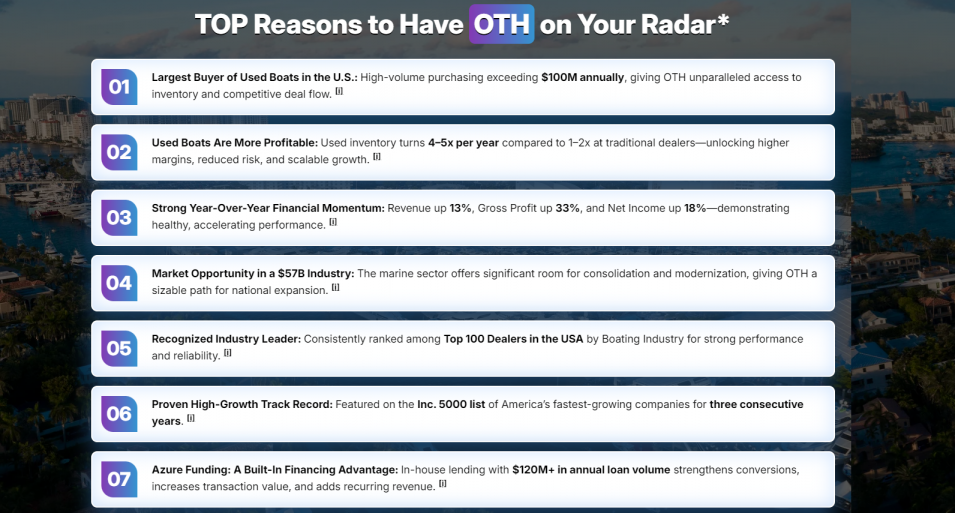

WILMINGTON, N.C. - WisconsinEagle -- Off The Hook YS Inc. (NYSE American: OTH) is rapidly redefining liquidity, transparency, and scale in the $57 billion U.S. marine industry. Following its successful November 2025 IPO, the company has entered a powerful new growth phase—highlighted by explosive early results from its newly launched luxury brokerage division, Autograph Yacht Group (AYG).

Since its October 2025 launch, Autograph Yacht Group has already secured over $100 million in luxury yacht listings and closed 22 transactions totaling approximately $35 million, signaling immediate traction in the high-end segment of the market. These early results underscore OTH's ability to translate its technology-driven wholesale platform into premium brokerage execution—an evolution few competitors have successfully achieved.

A Scaled Platform in a Fragmented Industry

Founded in 2012 by CEO Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. Headquartered in Wilmington, North Carolina, with operations across the East Coast and South Florida, OTH operates a nationwide network of offices and marinas, providing brokerage, wholesale, financing, and performance yacht sales under one integrated platform.

What differentiates OTH is its AI-assisted valuation engine and data-driven sales platform, which bring speed, pricing accuracy, and transparency to a traditionally opaque market. This proprietary technology enables OTH to operate as a liquidity provider—connecting buyers and sellers faster while managing inventory risk more effectively than traditional brokerages.

The company's execution has earned consistent recognition, including placement on the Inc. 500 and ranking among the Top 100 Boat Dealers in the United States.

Autograph Yacht Group: A Luxury Brokerage with Structural Advantages

More on Wisconsin Eagle

Autograph Yacht Group was launched to target yachts generally ranging from $500,000 to $20 million and above, focusing on high-discretion clients seeking a curated, boutique experience. Unlike traditional luxury brokerages, Autograph can accept trade-ins, a capability enabled by OTH's wholesale and AI-driven valuation infrastructure.

This creates a structural advantage:

Autograph's AI engine intelligently matches buyers and sellers by analyzing vessel data, client preferences, transaction history, and market conditions—enhancing both conversion rates and customer experience.

The division currently operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, with the newly announced Jupiter, FL office serving as Autograph Yacht Group's headquarters. The location places OTH at the center of one of the most active luxury boating corridors in the United States.

Strong Financial Momentum and Record Operating Metrics

OTH's operational momentum extends well beyond luxury brokerage.

Nine-Month 2025 Highlights (Ended September 30, 2025):

Third Quarter 2025 Highlights:

2026 Outlook: Scaling Toward $145 Million in Revenue

Building on its expanding platform and strong Q4 momentum, OTH has issued 2026 full-year revenue guidance of $140 million to $145 million—a significant step up from current levels and a reflection of expanding market share, improving margins, and growing contributions from luxury brokerage and financing operations.

More on Wisconsin Eagle

The company also stands to benefit from favorable macro and policy tailwinds. In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying boats and yachts purchased by January 19, 2026, allowing eligible business buyers to deduct the full purchase price in year one. Management reports this incentive has already boosted demand and is expected to further accelerate transaction volume into 2026.

Positioned for Long-Term Industry Growth

Beyond near-term sales momentum, OTH is strategically positioned in multiple expanding markets. The broader U.S. marine industry is valued at $57 billion, while the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to grow to $11.72 billion by 2033 at a 7.52% CAGR. OTH's scale, inventory access, and technology infrastructure provide optionality to participate across these value chains.

Independent Research Coverage Highlights Structural Opportunity

On December 8, 2025, Digital BD Deep initiated in-depth investor coverage with a report titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

The report analyzes OTH's technology-enabled business model, margin expansion potential, and positioning as a liquidity aggregator in a fragmented industry.

Full report available at:

https://www.digitalbdinc.com/report/othdeepresearch12-8-25.pdf

Bottom Line

With a successful IPO completed, record revenues, accelerating unit volumes, and a luxury brokerage division generating meaningful traction in its first quarter, Off The Hook YS Inc. is emerging as a technology-driven consolidator in the U.S. marine market. The combination of AI-powered valuation, nationwide scale, favorable tax policy, and expanding luxury exposure positions OTH for continued growth into 2026 and beyond.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Media & Investor Contact:

Chad Corbin, Chief Financial Officer

Email: IR@offthehookys.com

Phone: (561) 374-0513

Web: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Since its October 2025 launch, Autograph Yacht Group has already secured over $100 million in luxury yacht listings and closed 22 transactions totaling approximately $35 million, signaling immediate traction in the high-end segment of the market. These early results underscore OTH's ability to translate its technology-driven wholesale platform into premium brokerage execution—an evolution few competitors have successfully achieved.

A Scaled Platform in a Fragmented Industry

Founded in 2012 by CEO Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. Headquartered in Wilmington, North Carolina, with operations across the East Coast and South Florida, OTH operates a nationwide network of offices and marinas, providing brokerage, wholesale, financing, and performance yacht sales under one integrated platform.

What differentiates OTH is its AI-assisted valuation engine and data-driven sales platform, which bring speed, pricing accuracy, and transparency to a traditionally opaque market. This proprietary technology enables OTH to operate as a liquidity provider—connecting buyers and sellers faster while managing inventory risk more effectively than traditional brokerages.

The company's execution has earned consistent recognition, including placement on the Inc. 500 and ranking among the Top 100 Boat Dealers in the United States.

Autograph Yacht Group: A Luxury Brokerage with Structural Advantages

More on Wisconsin Eagle

- Breakout Phase for Public Company: New Partnerships, Zero Debt, and $20 Million Growth Capital Position Company for 2026 Acceleration

- Japan's Patented "Hammock'n" Smartphone Band Targets Hand Fatigue From Long Phone Use

- Reditus Group Introduces A New Empirical Model for Early-Stage B2B Growth

- CCHR: Harvard Review Exposes Institutional Corruption in Global Mental Health

- Goatimus Launches Dynamic Context: AI Prompt Engineering Gets Smarter

Autograph Yacht Group was launched to target yachts generally ranging from $500,000 to $20 million and above, focusing on high-discretion clients seeking a curated, boutique experience. Unlike traditional luxury brokerages, Autograph can accept trade-ins, a capability enabled by OTH's wholesale and AI-driven valuation infrastructure.

This creates a structural advantage:

- Faster deal velocity

- Expanded buyer pool

- More accurate pricing

- Reduced friction for sellers

Autograph's AI engine intelligently matches buyers and sellers by analyzing vessel data, client preferences, transaction history, and market conditions—enhancing both conversion rates and customer experience.

The division currently operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, with the newly announced Jupiter, FL office serving as Autograph Yacht Group's headquarters. The location places OTH at the center of one of the most active luxury boating corridors in the United States.

Strong Financial Momentum and Record Operating Metrics

OTH's operational momentum extends well beyond luxury brokerage.

Nine-Month 2025 Highlights (Ended September 30, 2025):

- Record revenue: $82.6 million, up 19.3% year-over-year

- Boats sold: 310 units, up 24.4%

- Net income: $0.8 million

- Gross profit: $8.4 million, up from $6.9 million in 2024

- Adjusted EBITDA: $2.6 million

Third Quarter 2025 Highlights:

- Revenue of $24.0 million

- 112 boats sold, up 51.1% YOY

- Second-highest quarterly unit volume in company history

- Gross profit of $3.0 million

- Launch of Autograph Yacht Group

- Addition of 10 new brokers

2026 Outlook: Scaling Toward $145 Million in Revenue

Building on its expanding platform and strong Q4 momentum, OTH has issued 2026 full-year revenue guidance of $140 million to $145 million—a significant step up from current levels and a reflection of expanding market share, improving margins, and growing contributions from luxury brokerage and financing operations.

More on Wisconsin Eagle

- Global License Exclusive Secured for Emesyl OTC Nausea Relief, Expanding Multi-Product Growth Strategy for Caring Brands, Inc. (N A S D A Q: CABR)

- RNHA Affirms Support for President Trump as Nation Marks Historic Victory for Freedom

- American Laser Study Club Announces 2026 Kumar Patel Prize in Laser Surgery Recipients: Ann Bynum, DDS, and Boaz Man, DVM

- Lineus Medical Completes UK Registration for SafeBreak® Vascular

The company also stands to benefit from favorable macro and policy tailwinds. In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying boats and yachts purchased by January 19, 2026, allowing eligible business buyers to deduct the full purchase price in year one. Management reports this incentive has already boosted demand and is expected to further accelerate transaction volume into 2026.

Positioned for Long-Term Industry Growth

Beyond near-term sales momentum, OTH is strategically positioned in multiple expanding markets. The broader U.S. marine industry is valued at $57 billion, while the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to grow to $11.72 billion by 2033 at a 7.52% CAGR. OTH's scale, inventory access, and technology infrastructure provide optionality to participate across these value chains.

Independent Research Coverage Highlights Structural Opportunity

On December 8, 2025, Digital BD Deep initiated in-depth investor coverage with a report titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

The report analyzes OTH's technology-enabled business model, margin expansion potential, and positioning as a liquidity aggregator in a fragmented industry.

Full report available at:

https://www.digitalbdinc.com/report/othdeepresearch12-8-25.pdf

Bottom Line

With a successful IPO completed, record revenues, accelerating unit volumes, and a luxury brokerage division generating meaningful traction in its first quarter, Off The Hook YS Inc. is emerging as a technology-driven consolidator in the U.S. marine market. The combination of AI-powered valuation, nationwide scale, favorable tax policy, and expanding luxury exposure positions OTH for continued growth into 2026 and beyond.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Media & Investor Contact:

Chad Corbin, Chief Financial Officer

Email: IR@offthehookys.com

Phone: (561) 374-0513

Web: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on Wisconsin Eagle

- Lacy Hendricks Earns Prestigious MPM® Designation from NARPM®

- Walmart $WMT and COSTCO.COM $COST Distribution as SonicShieldX™ Platform Sets the Stage for Accelerated Growth in 2026: AXIL Brands (N Y S E: AXIL)

- AI-Driven Drug Development with Publication of New Bioinformatics Whitepaper for BullFrog AI: $BFRG Strengthens Its Position in AI Drug Development

- IQSTEL Enters 2026 from a Position of Strength Following Transformational Year Marked by N A S D A Q Uplisting, Record Revenue and First-Ever

- Are You Hiring The Right Heater Repair Company in Philly?

- Appliance EMT Expands Professional Appliance Repair Services to Hartford, Connecticut

- Java Holdings LLC Acquires +Peptide, Expanding Portfolio Across Coffee, Science, and Functional Nutrition

- OneSolution® Expands to Orlando with New Altamonte Springs Implant Center

- Indian Peaks Veterinary Hospital Launches Updated Dental Services Page for Boulder Pet Owners

- Dugan Air Donates $10,000 to Indian Creek Schools

- Robert DeMaio, Phinge Founder & CEO, Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- 2025: A Turning Point for Human Rights. CCHR Demands End to Coercive Psychiatry

- The 22% Tax Reality: Finland's New Gambling Law Creates a "Fiscal Trap" for Grey Market Casino Players

- Phinge Founder & CEO Robert DeMaio Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- Donna Cardellino Manager/Facilitator Signs Justin Jeansonne Country Singer-Songwriter To Exclusive Management Deal For Global Music Expansion

- Golden Paper Launches a New Chapter in Its Americas Strategy- EXPOPRINT Latin America 2026 in Brazil

- UK Financial Ltd Executes Compliance Tasks Ahead Of First-Ever ERC-3643 Exchange-Traded Token, SMCAT & Sets Date For Online Investor Governance Vote

- TheOneLofi2: New Home for Chill Lo-Fi Hip Hop Beats Launches on YouTube

- eJoule Inc Participates in Silicon Dragon CES 2026

- HBZBZL Unveils "Intelligent Ecosystem" Strategy: Integrating AI Analytics with Web3 Incubation