Trending...

- Triple-Digit Growth, Strategic N A S D A Q Uplist, Plus A Scalable Healthcare Rollout Model: Stock Symbol: CDIX

- 59-Acre Germantown Horse Farm Sells for $1.3 Million

- Ludex Partners With Certified Trading Card Association (CTCA) To Elevate Standards And Innovation In The Trading Card Industry

Off The Hook YS Inc. (N Y S E American: OTH): Digital BD Deep Releases Comprehensive Research Report as OTH Prepares for December 15 Earnings Call

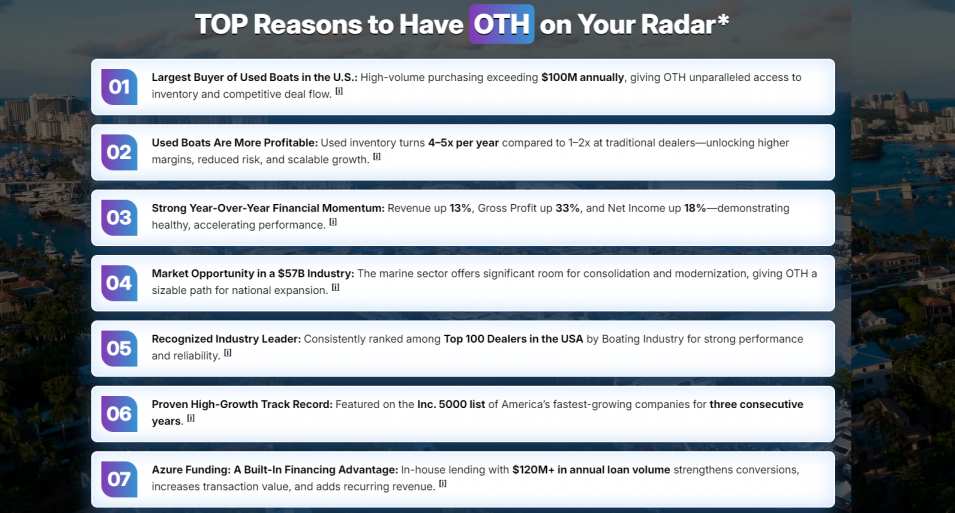

WASHINGTON, N.C. - WisconsinEagle -- Off The Hook YS Inc. (N Y S E American: OTH), one of America's largest buyers and sellers of pre-owned boats, is heading into year-end 2025 with accelerating momentum across its core business, a successful IPO behind it, and major new growth initiatives underway. With operations spanning the East Coast and South Florida, OTH acquires more than $100 million in boats and yachts each year and continues to scale its technology-driven platform to serve a U.S. marine industry valued at $57 billion.

Comprehensive New Research Coverage

On December 8, 2025, Digital BD Deep released an in-depth investor research report titled:

Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market.

The report profiles OTH's national presence, its role in the marine liquidity ecosystem, and its strategic expansion into luxury brokerage under the newly launched Autograph Yacht Group (AYG). It highlights OTH's growth initiatives, technology adoption, and positioning within a marine sector that remains highly fragmented and ripe for consolidation.

Upcoming Q3 Earnings Release and Conference Call

Investors will receive fresh insight into the company's financial performance when OTH reports its Q3 2025 results on Monday, December 15, 2025, after market close.

A live conference call will follow at 4:30 p.m. ET.

A webcast and replay will be available through the Investor Relations page on the OTH website.

Industry Tailwinds: 100% Bonus Depreciation Returns

More on Wisconsin Eagle

On December 1, the company reminded buyers of a powerful tax incentive now driving demand across the marine market. The "One Big Beautiful Bill Act" (OBBBA), signed into law in July 2025, reinstated 100% bonus depreciation on qualifying business assets—including boats and yachts—through January 19, 2026.

Eligible buyers who use a vessel for more than 50% business purposes can deduct the full purchase price in year one, a catalyst that OTH believes will stimulate significant year-end and early-2026 activity.

"This incentive is a game-changer for anyone considering a boat purchase," said Jason Ruegg, Founder and President of OTH. "Our expanding brokerage team has already helped countless business owners identify qualifying vessels, and we expect demand to surge further."

Given its broad, all-brand inventory and national footprint, OTH is positioned to capture outsized benefit from this tax-driven buying window.

Expansion Into Luxury Brokerage: New Jupiter, Florida Headquarters

On November 25, OTH confirmed the development of a new office in Jupiter, Florida, which will serve as the headquarters for its luxury brokerage division, the Autograph Yacht Group (AYG). Led by industry veteran Mike Burke, AYG targets the high-end yacht market—a segment where Florida remains the nation's strongest hub.

The new location includes modern office space and six on-site slips for premium inventory. Build-out is underway, with completion expected in early 2026.

"The Jupiter location enhances our presence in one of the world's premier yachting markets," said Brian S. John, CEO of OTH. "It will serve both our leadership team and our expanding luxury brokerage division."

Successful IPO Supports Growth and Market Reach

On November 14, OTH completed its initial public offering of 3,750,000 shares at $4.00 per share, generating $15 million in gross proceeds. The company granted underwriters an additional 45-day option to purchase up to 562,500 shares to cover over-allotments.

More on Wisconsin Eagle

Proceeds will be used to:

ThinkEquity acted as sole book-running manager for the offering.

Harnessing Technology and Data in a Traditionally Fragmented Market

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, OTH leverages AI-assisted valuation tools and a data-driven sales platform to streamline yacht transactions—a process historically known for opacity and slow negotiation cycles.

The company's multi-state network of offices and marinas supports brokerage, wholesale, and performance yacht sales, giving buyers and sellers access to one of the nation's broadest pre-owned inventories.

OTH has earned repeated recognition on the Inc. 500 and ranks among the Top 100 Dealers in the United States, reflecting both rapid growth and operational excellence.

Growth Outlook Beyond 2025

In addition to the $57 billion U.S. marine industry, OTH is positioned to benefit from adjacent markets. The U.S. Ship Repair and Maintenance Services Market, valued at $6.55 billion in 2025, is projected to nearly double to $11.72 billion by 2033 (7.52% CAGR). This long-term expansion provides a favorable backdrop for OTH's evolving service offerings and national footprint.

About Off The Hook YS Inc. (OTH)

Off The Hook YS Inc. (NYSE American: OTH) is a leading buyer and seller of pre-owned boats in the United States. Through a nationwide network of marinas and offices, advanced valuation technology, and a fast-growing luxury brokerage division, OTH provides comprehensive solutions for buyers, sellers, and partners across the marine industry.

For More Information

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Website: offthehookyachts.com | compasslivemedia.com/oth

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Comprehensive New Research Coverage

On December 8, 2025, Digital BD Deep released an in-depth investor research report titled:

Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market.

The report profiles OTH's national presence, its role in the marine liquidity ecosystem, and its strategic expansion into luxury brokerage under the newly launched Autograph Yacht Group (AYG). It highlights OTH's growth initiatives, technology adoption, and positioning within a marine sector that remains highly fragmented and ripe for consolidation.

Upcoming Q3 Earnings Release and Conference Call

Investors will receive fresh insight into the company's financial performance when OTH reports its Q3 2025 results on Monday, December 15, 2025, after market close.

A live conference call will follow at 4:30 p.m. ET.

- Domestic Dial-In: (800) 715-9871

- International Dial-In: (646) 307-1963

- Passcode: 5863262

A webcast and replay will be available through the Investor Relations page on the OTH website.

Industry Tailwinds: 100% Bonus Depreciation Returns

More on Wisconsin Eagle

- Tarrytown Expocare Pharmacy Announces Strategic Leadership Appointments to Accelerate Growth and Innovation

- New Environmental Thriller "The Star Thrower" Reimagines a Classic Lesson in Individual Impact

- Summit Appoints Javier Cabeza as Data, AI, and Analytics Practice Lead

- March Is Skiing's Smartest Buying Window

- Cancun Airport Transportation Expands Fleet Ahead of Record Passenger Growth at Cancun International Airport

On December 1, the company reminded buyers of a powerful tax incentive now driving demand across the marine market. The "One Big Beautiful Bill Act" (OBBBA), signed into law in July 2025, reinstated 100% bonus depreciation on qualifying business assets—including boats and yachts—through January 19, 2026.

Eligible buyers who use a vessel for more than 50% business purposes can deduct the full purchase price in year one, a catalyst that OTH believes will stimulate significant year-end and early-2026 activity.

"This incentive is a game-changer for anyone considering a boat purchase," said Jason Ruegg, Founder and President of OTH. "Our expanding brokerage team has already helped countless business owners identify qualifying vessels, and we expect demand to surge further."

Given its broad, all-brand inventory and national footprint, OTH is positioned to capture outsized benefit from this tax-driven buying window.

Expansion Into Luxury Brokerage: New Jupiter, Florida Headquarters

On November 25, OTH confirmed the development of a new office in Jupiter, Florida, which will serve as the headquarters for its luxury brokerage division, the Autograph Yacht Group (AYG). Led by industry veteran Mike Burke, AYG targets the high-end yacht market—a segment where Florida remains the nation's strongest hub.

The new location includes modern office space and six on-site slips for premium inventory. Build-out is underway, with completion expected in early 2026.

"The Jupiter location enhances our presence in one of the world's premier yachting markets," said Brian S. John, CEO of OTH. "It will serve both our leadership team and our expanding luxury brokerage division."

Successful IPO Supports Growth and Market Reach

On November 14, OTH completed its initial public offering of 3,750,000 shares at $4.00 per share, generating $15 million in gross proceeds. The company granted underwriters an additional 45-day option to purchase up to 562,500 shares to cover over-allotments.

More on Wisconsin Eagle

- Tobu Group's "T-home Series" of Accommodations in Tokyo Just Opened "T-home KEI."

- Custom Wooden Token Manufacturer Celebrates 10 Years of Helping Brands Stay Top of Mind

- NaturismRE Launches the NRE Health Institute to Advance Evidence-Informed Public Health Research

- P-Wave Classics to publish Robert Bage's Hermsprong in three volumes, beginning 12 May

- Progressive Dental & The Closing Institute Partner with Zest Dental Solutions to Elevate Full-Arch Growth and Patient Outcomes

Proceeds will be used to:

- Support floorplan financing

- Expand marketing and advertising

- Repay a promissory note

- Strengthen working capital

ThinkEquity acted as sole book-running manager for the offering.

Harnessing Technology and Data in a Traditionally Fragmented Market

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, OTH leverages AI-assisted valuation tools and a data-driven sales platform to streamline yacht transactions—a process historically known for opacity and slow negotiation cycles.

The company's multi-state network of offices and marinas supports brokerage, wholesale, and performance yacht sales, giving buyers and sellers access to one of the nation's broadest pre-owned inventories.

OTH has earned repeated recognition on the Inc. 500 and ranks among the Top 100 Dealers in the United States, reflecting both rapid growth and operational excellence.

Growth Outlook Beyond 2025

In addition to the $57 billion U.S. marine industry, OTH is positioned to benefit from adjacent markets. The U.S. Ship Repair and Maintenance Services Market, valued at $6.55 billion in 2025, is projected to nearly double to $11.72 billion by 2033 (7.52% CAGR). This long-term expansion provides a favorable backdrop for OTH's evolving service offerings and national footprint.

About Off The Hook YS Inc. (OTH)

Off The Hook YS Inc. (NYSE American: OTH) is a leading buyer and seller of pre-owned boats in the United States. Through a nationwide network of marinas and offices, advanced valuation technology, and a fast-growing luxury brokerage division, OTH provides comprehensive solutions for buyers, sellers, and partners across the marine industry.

For More Information

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Website: offthehookyachts.com | compasslivemedia.com/oth

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on Wisconsin Eagle

- Lineus Medical's SafeBreak® Vascular Added to Alliant GPO Contract

- Cancun All Inclusive is ready for Spring Break 2026 with new Resorts, Exclusive Deals, activities and more!

- 66% of US Bankruptcies Are Medical — So Americans Are Building Businesses That Cover Healthcare Emergencies

- Ludex Partners With Certified Trading Card Association (CTCA) To Elevate Standards And Innovation In The Trading Card Industry

- 59-Acre Germantown Horse Farm Sells for $1.3 Million

- Best Book Publishing Company for Aspiring Authors

- Dr. Nadene Rose Releases Moving Memoir on Faith, Grief, and Divine Presence

- Gigasoft Solves AI's Biggest Charting Code Problem: Hallucinated Property Names

- ASTI Ignites the Space Economy: Powering SpaceX's NOVI AI Pathfinder with Breakthrough Solar Technology: Ascent Solar Technologies (N A S D A Q: ASTI)

- Hiring has reached a "Digital Stalemate"—Now, an ex-Google recruiter is giving candidates the answers

- 2026 Pre-Season Testing Confirms a Two-Tier Grid as Energy Management Defines Formula 1's New Era

- Platinum Car Audio LLC Focuses on Customer-Driven Vehicle Audio and Electronics Solutions

- Postmortem Pathology Expands Independent Autopsy Services in Kansas City

- Postmortem Pathology Expands Independent Autopsy Services Across Colorado

- Man on Historic 50 State Trek on Foot reaches Wisconsin : 44 States Complete, 6 States Remain

- $38 Million in U.S. Government Contract Awards Secured Through Strategic Partner. Establishing Multi-Year Defense Revenue Platform Through 2032: $BLIS

- Mecpow M1: A Safe & Affordable Laser Engraver Built for Home DIY Beginners

- CrashStory.com Launches First Colorado Crash Data Platform Built for Victims, Not Lawyers

- "When The Call Hits Home" Podcast Announces Special Coverage at Global ILEETA Conference

- Inkdnylon Earns BBB Accreditation for Verified Business Integrity