Trending...

- Triple-Digit Growth, Strategic N A S D A Q Uplist, Plus A Scalable Healthcare Rollout Model: Stock Symbol: CDIX

- 59-Acre Germantown Horse Farm Sells for $1.3 Million

- 505 Plumbing, Heating & Cooling Launches in Albuquerque, Bringing a Customer-First Approach to Home Services

IQSTEL, Inc. (N A S D A Q: IQST) $IQST Reports $12.23 in Assets per Share and $4.66 in Equity Per Share! Undervalued by Dollars.

CORAL GABLES, Fla. - WisconsinEagle -- IQSTEL, Inc. (N A S D A Q: IQST) is emerging as a differentiated global technology platform following a landmark 2025 that fundamentally reshaped the company's scale, credibility, and growth trajectory. With a successful NASDAQ uplisting, a revenue run rate exceeding $400 million, expanding profitability, entry into AI-driven cybersecurity, and the declaration of its first-ever shareholder dividend, IQST appears positioned for what management describes as an unprecedented 2026.

From Telecom Operator to Diversified Global Technology Platform

Operating across 21 countries, IQST delivers high-value services spanning telecommunications, fintech, artificial intelligence, blockchain, cybersecurity, and electric vehicle solutions. The company has spent years building a trusted commercial platform, selling millions of dollars per month to global customers—particularly telecom operators.

By leveraging those established relationships, IQST is now accelerating the rollout of higher-margin, technology-driven products, transforming the business from a traditional telecom operator into a diversified, scalable digital services provider.

This evolution is central to IQST's long-term roadmap, which targets a $15 million EBITDA run rate in 2026 and a $1 billion revenue run rate by 2027 through organic growth, acquisitions, and expanded high-margin offerings.

Record Revenue Growth and Improving Profitability

IQST's financial performance in 2025 underscores the strength of its platform and execution.

In Q3 2025, the company delivered:

For the nine months ended September 30, 2025, revenue reached $232.6 million, up 26% year-over-year.

More on Wisconsin Eagle

The balance sheet also strengthened meaningfully, with:

Debt-Free N A S D A Q Company with a Clean Capital Structure

In October, $IQST completed the elimination of all convertible notes and fully paid for its most recent acquisitions, officially becoming a debt-free NASDAQ-listed company with no warrants or convertible securities outstanding.

This clean capital structure is notable in the small-cap technology space and reflects management's stated focus on long-term shareholder value, disciplined execution, and financial transparency.

Fintech Division Gains Momentum with Globetopper

IQST's Fintech division, now representing approximately 20% of total revenue, is playing an increasingly important role in profitability.

The acquisition of Globetopper, completed July 1, 2025, is already contributing meaningfully:

IQST plans to leverage its existing relationships with more than 600 telecom operators worldwide to cross-sell Globetopper's fintech services, unlocking scale efficiencies and margin expansion.

Strategic Expansion into AI and Cybersecurity

During 2025, IQST formally expanded into AI-enhanced cybersecurity, partnering with Cycurion (N A S D A Q: CYCU). In October, the company completed Phase One of its next-generation cyber defense rollout, integrating its proprietary AI platforms—Airweb.ai and IQ2Call.ai—with Cycurion's ARx multi-layer cybersecurity system.

This milestone positions IQST to deliver secure, AI-powered digital communication and customer engagement solutions to enterprises, telecom operators, and regulated industries.

In parallel, $IQST continues to deploy proprietary AI technologies across its business, including partnerships with U.S.-based healthcare call centers to implement next-generation AI communication systems.

More on Wisconsin Eagle

First-Ever Dividend Signals Confidence and Maturity

One of the most notable developments of 2025 was IQST's announcement of its first-ever shareholder dividend—a $500,000 distribution payable in free-trading IQST common shares.

The dividend, declared in December and distributed to shareholders of record as of December 15, reflects management's confidence in the company's financial position and long-term strategy. It also signals a shift toward a more mature capital allocation approach while maintaining aggressive growth objectives.

Growing Institutional Visibility

Following the N A S D A Q uplisting, IQST has expanded its institutional outreach:

These developments are increasing IQST's visibility among long-term investors as it transitions into its next growth phase.

Looking Ahead: Execution and Scale in 2026

With foundational milestones achieved, IQST enters 2026 focused on execution:

Following a year defined by transformation, IQST now appears positioned to capitalize on its expanded platform, strengthened balance sheet, and diversified revenue streams—setting the stage for what could be its most consequential growth phase yet.

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

Company Contact:

IQSTEL, Inc. (N A S D A Q: IQST)

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

From Telecom Operator to Diversified Global Technology Platform

Operating across 21 countries, IQST delivers high-value services spanning telecommunications, fintech, artificial intelligence, blockchain, cybersecurity, and electric vehicle solutions. The company has spent years building a trusted commercial platform, selling millions of dollars per month to global customers—particularly telecom operators.

By leveraging those established relationships, IQST is now accelerating the rollout of higher-margin, technology-driven products, transforming the business from a traditional telecom operator into a diversified, scalable digital services provider.

This evolution is central to IQST's long-term roadmap, which targets a $15 million EBITDA run rate in 2026 and a $1 billion revenue run rate by 2027 through organic growth, acquisitions, and expanded high-margin offerings.

Record Revenue Growth and Improving Profitability

IQST's financial performance in 2025 underscores the strength of its platform and execution.

In Q3 2025, the company delivered:

- Record quarterly revenue of $102.8 million, representing 42% sequential growth and 90% year-over-year growth

- A revenue run rate of $411.5 million

- Adjusted EBITDA of $683,189 for the quarter

- Adjusted EBITDA run rate of $2.73 million

For the nine months ended September 30, 2025, revenue reached $232.6 million, up 26% year-over-year.

More on Wisconsin Eagle

- Juego Studios Extends Full-Cycle Game Development & Outsourcing Capabilities to the UAE Market

- VENUS Goes Live on CATEX Exchange As UK Financial Ltd Activates The Premier Division Of The Maya Meme's League

- Atlanta Tech Founder Seeks Clarity on Intellectual Property and Innovation Policy

- Purple Heart Recipient Honored by Hall of Fame Son In Viral Tribute Sparking National Conversation on Service Fatherhood, Healing and Legacy

- Amicly Launches as a Safety-First Social App Designed to Help People Build Real, Meaningful Friendships

The balance sheet also strengthened meaningfully, with:

- $46.8 million in total assets ($12.23 per share)

- $17.8 million in stockholders' equity ($4.66 per share), reflecting a 50% increase from year-end 2024

Debt-Free N A S D A Q Company with a Clean Capital Structure

In October, $IQST completed the elimination of all convertible notes and fully paid for its most recent acquisitions, officially becoming a debt-free NASDAQ-listed company with no warrants or convertible securities outstanding.

This clean capital structure is notable in the small-cap technology space and reflects management's stated focus on long-term shareholder value, disciplined execution, and financial transparency.

Fintech Division Gains Momentum with Globetopper

IQST's Fintech division, now representing approximately 20% of total revenue, is playing an increasingly important role in profitability.

The acquisition of Globetopper, completed July 1, 2025, is already contributing meaningfully:

- Approximately $16 million in Q3 2025 revenue

- Positive EBITDA contribution in its first full quarter

IQST plans to leverage its existing relationships with more than 600 telecom operators worldwide to cross-sell Globetopper's fintech services, unlocking scale efficiencies and margin expansion.

Strategic Expansion into AI and Cybersecurity

During 2025, IQST formally expanded into AI-enhanced cybersecurity, partnering with Cycurion (N A S D A Q: CYCU). In October, the company completed Phase One of its next-generation cyber defense rollout, integrating its proprietary AI platforms—Airweb.ai and IQ2Call.ai—with Cycurion's ARx multi-layer cybersecurity system.

This milestone positions IQST to deliver secure, AI-powered digital communication and customer engagement solutions to enterprises, telecom operators, and regulated industries.

In parallel, $IQST continues to deploy proprietary AI technologies across its business, including partnerships with U.S.-based healthcare call centers to implement next-generation AI communication systems.

More on Wisconsin Eagle

- Primeindexer Google indexing platform launched by SEO Danmark APS

- Kaltra Introduces New Downward-Spraying Distribution Technology to Boost Microchannel Evaporator Performance

- Talentica Announces Winners of Multi-Agent Hackathon 2026

- NeuroAcoustic Pioneer Dr. Chris Potter Unveils QLL Technology to Disrupt Mental Health Industry

- Special Alert: Undervalued Opportunity: IQSTEL (N A S D A Q: IQST) Positioned for Explosive Multi-Year Growth

First-Ever Dividend Signals Confidence and Maturity

One of the most notable developments of 2025 was IQST's announcement of its first-ever shareholder dividend—a $500,000 distribution payable in free-trading IQST common shares.

The dividend, declared in December and distributed to shareholders of record as of December 15, reflects management's confidence in the company's financial position and long-term strategy. It also signals a shift toward a more mature capital allocation approach while maintaining aggressive growth objectives.

Growing Institutional Visibility

Following the N A S D A Q uplisting, IQST has expanded its institutional outreach:

- 20+ institutional investors now hold approximately 5% of outstanding shares

- Management initiated a webinar roadshow targeting institutions and family offices

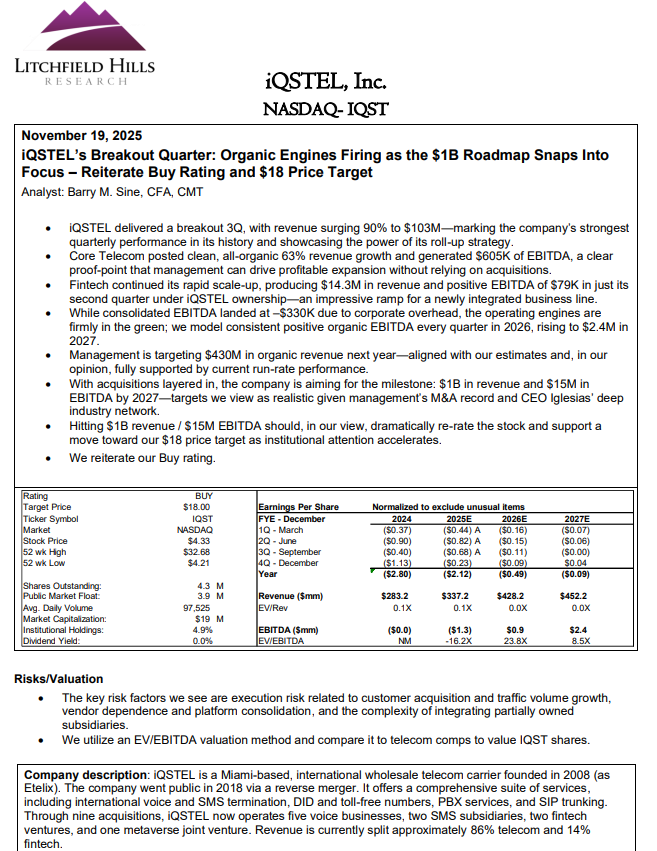

- Independent research coverage was initiated by Litchfield Hills Research, which issued a report with an $18 price target

These developments are increasing IQST's visibility among long-term investors as it transitions into its next growth phase.

Looking Ahead: Execution and Scale in 2026

With foundational milestones achieved, IQST enters 2026 focused on execution:

- Scaling high-margin fintech, AI, and cybersecurity services

- Advancing toward a $15 million EBITDA run rate

- Continuing progress toward a $1 billion revenue objective by 2027

Following a year defined by transformation, IQST now appears positioned to capitalize on its expanded platform, strengthened balance sheet, and diversified revenue streams—setting the stage for what could be its most consequential growth phase yet.

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

Company Contact:

IQSTEL, Inc. (N A S D A Q: IQST)

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on Wisconsin Eagle

- Postmortem Pathology Expands Independent Autopsy Services Across Colorado

- Man on Historic 50 State Trek on Foot reaches Wisconsin : 44 States Complete, 6 States Remain

- $38 Million in U.S. Government Contract Awards Secured Through Strategic Partner. Establishing Multi-Year Defense Revenue Platform Through 2032: $BLIS

- Mecpow M1: A Safe & Affordable Laser Engraver Built for Home DIY Beginners

- CrashStory.com Launches First Colorado Crash Data Platform Built for Victims, Not Lawyers

- "When The Call Hits Home" Podcast Announces Special Coverage at Global ILEETA Conference

- Inkdnylon Earns BBB Accreditation for Verified Business Integrity

- Josh Stout "The Western Project"

- Keeper Goals Completes Multi-Sport Installation at Nex-Gen Performance Sports Complex

- Open House Momentum Builds at Heritage at South Brunswick

- A Celebration of Visibility, Voice and Excellence: The 57th NAACP Image Awards Golf Invitational, Presented by Wells Fargo, A PGD Global Production

- Athens in Spring: A Culinary City Break That Rivals Paris and Copenhagen

- ClearSight Therapeutics Signs LOI with Covalent Medical for $60M Multi-Channel OTC Eye Care Partnership

- Jayne Williams Joins Century Fasteners Corp. Sales and Business Development Team

- The Retirement Advantage, Inc. (TRA) Promotes Austin Solomon to Regional Plan Consultant

- Rocket Fibre Services Growing Customer Base With netElastic Networking Software

- Cummings Graduate Institute for Behavioral Health Studies Honors New Doctor of Behavioral Health Graduates

- IDpack v4 Launches: A Major Evolution in Cloud-Based ID Card Issuance

- CCHR Says Psychiatry's Admission on Antidepressant Withdrawal Comes Far Too Late

- 505 Plumbing, Heating & Cooling Launches in Albuquerque, Bringing a Customer-First Approach to Home Services