Trending...

- Nextvisit Co-Founder Ryan Yannelli Identifies Six Critical Factors for Behavioral Health Providers Evaluating AI Scribes in 2026

- Price Improvement on Luxurious Lāna'i Townhome with Stunning Ocean Views

- CredHub and Real Property Management Join Forces to Empower Franchise Owners with Rental Payment Credit Reporting Solutions

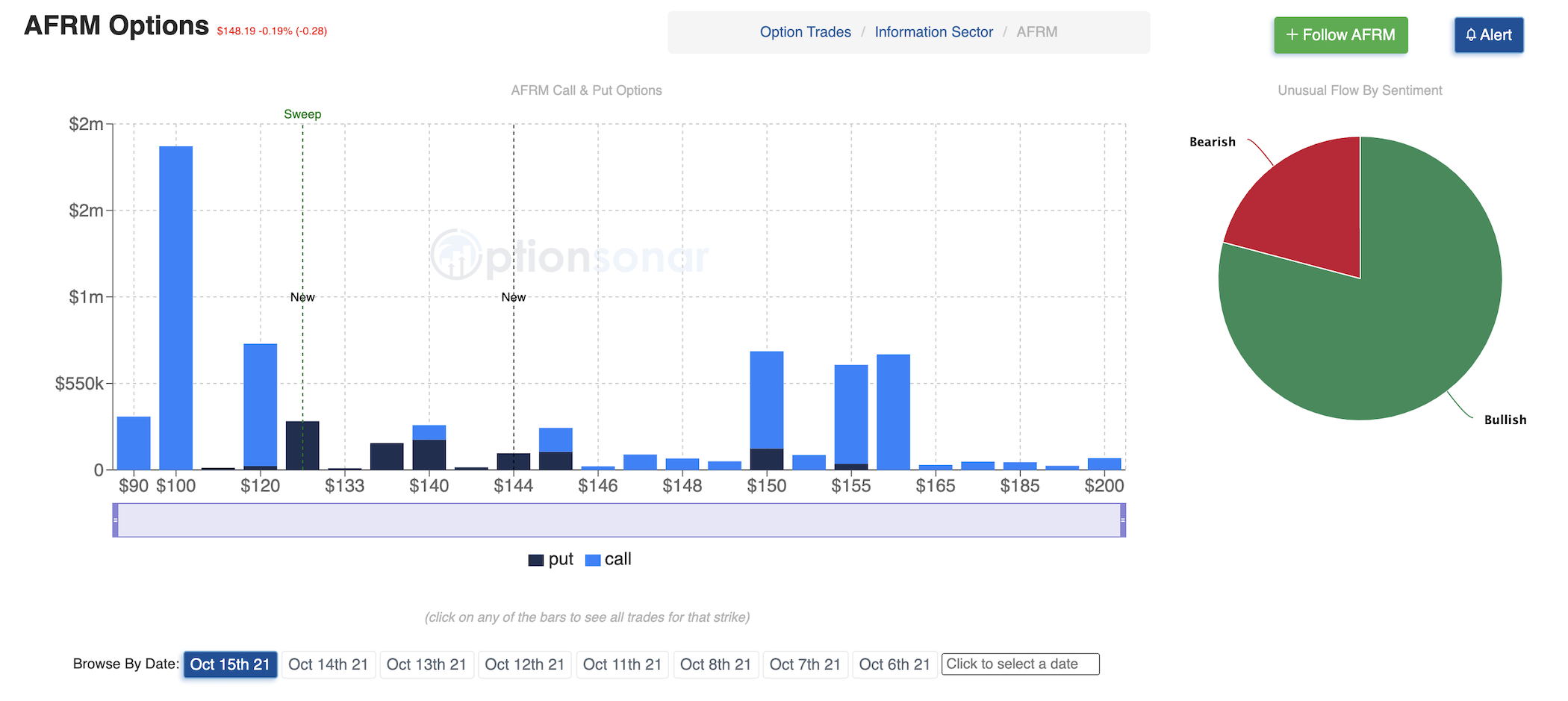

SAN FRANCISCO - WisconsinEagle -- Affirm's stock, a publicly traded financial technology company, captured substantial at the money call stock options expiring at the end of the year. Many traders use in-the-money stock options to leverage their exposure to the underlying stock. They are referred to as stock replacement trades as they require less capital to enter but are subject to the same level of directional risk as owning the underlying equity directly. Our unusual options activity research from this week dictates that option traders expect AFRM's stock price to reach $200 by the end of the year.

View the latest unusual options activity for AFRM stock

Option prices are a good indicator of stock price movements. However, even though options are traditionally thought of as a hedge instrument, due to their high leverage, they are also often used by large institutional buyers to capitalize on large stock movements.

You may not be able to tell from a glance, but not all option trades are created equal. Some carry more information than others - and unusual option trades are that type of trade.

More on Wisconsin Eagle

Unusual options activity is a type of trade being bought on the ask or sold on the bid, with unusual volume and/or trade size. This means that these are new contracts being traded, expressing a fresh opinion on the stock.

Why is this interesting? Well given a large enough trade and it being bought on the ask or sold on the bid it shows extreme urgency on the trader's side.

For example, let's look at a trade of 5,000 calls which had a bid and ask spread of $3.00 by $3.70 respectively, and the order was executed on the ask at $3.70.

What does that tell us?

The trader bought 5,000 call contracts, dropping $1.8M on the trade. Now, if they were patient and waited to fill the order in the middle of the bid and ask spread, say $3.35, they could have saved potentially $175K, but they didn't. To me, that says they have high expectations for this trade, and saving $175K is chump change.

A large purchase of call options carries a signal that there is a likelihood of a large move in the underlying stock.

Optionsonar is a cutting-edge service that provides investors with the latest unusual options activity in an easy-to-read format. The software has been exclusively available to institutional traders on Wall Street, but now it's available to you!

View the latest unusual options activity for AFRM stock

Option prices are a good indicator of stock price movements. However, even though options are traditionally thought of as a hedge instrument, due to their high leverage, they are also often used by large institutional buyers to capitalize on large stock movements.

You may not be able to tell from a glance, but not all option trades are created equal. Some carry more information than others - and unusual option trades are that type of trade.

More on Wisconsin Eagle

- Phinge Founder & CEO Robert DeMaio Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- Donna Cardellino Manager/Facilitator Signs Justin Jeansonne Country Singer-Songwriter To Exclusive Management Deal For Global Music Expansion

- Golden Paper Launches a New Chapter in Its Americas Strategy- EXPOPRINT Latin America 2026 in Brazil

- UK Financial Ltd Executes Compliance Tasks Ahead Of First-Ever ERC-3643 Exchange-Traded Token, SMCAT & Sets Date For Online Investor Governance Vote

- TheOneLofi2: New Home for Chill Lo-Fi Hip Hop Beats Launches on YouTube

Unusual options activity is a type of trade being bought on the ask or sold on the bid, with unusual volume and/or trade size. This means that these are new contracts being traded, expressing a fresh opinion on the stock.

Why is this interesting? Well given a large enough trade and it being bought on the ask or sold on the bid it shows extreme urgency on the trader's side.

For example, let's look at a trade of 5,000 calls which had a bid and ask spread of $3.00 by $3.70 respectively, and the order was executed on the ask at $3.70.

What does that tell us?

The trader bought 5,000 call contracts, dropping $1.8M on the trade. Now, if they were patient and waited to fill the order in the middle of the bid and ask spread, say $3.35, they could have saved potentially $175K, but they didn't. To me, that says they have high expectations for this trade, and saving $175K is chump change.

A large purchase of call options carries a signal that there is a likelihood of a large move in the underlying stock.

Optionsonar is a cutting-edge service that provides investors with the latest unusual options activity in an easy-to-read format. The software has been exclusively available to institutional traders on Wall Street, but now it's available to you!

Source: Optionsonar

0 Comments

Latest on Wisconsin Eagle

- Trump's Executive Order Rescheduling Cannabis: Accelerating M&A in a Multibillion-Dollar Industry

- Genuine Hospitality, LLC Selected to Operate Hilton Garden Inn Birmingham SE / Liberty Park

- Documentary "Prescription for Violence: Psychiatry's Deadly Side Effects" Premieres, Exposes Link Between Psychiatric Drugs and Acts of Mass Violence

- Price Improvement on Luxurious Lāna'i Townhome with Stunning Ocean Views

- Nextvisit Co-Founder Ryan Yannelli Identifies Six Critical Factors for Behavioral Health Providers Evaluating AI Scribes in 2026

- Moor Downs Golf Course Partners With Keeper Goals on New Protective Barrier Netting System

- CredHub and Real Property Management Join Forces to Empower Franchise Owners with Rental Payment Credit Reporting Solutions

- Leimert Park Announces Weeklong Kwanzaa Festival & Kwanzaa Parade Celebrating Black History, Culture, and Community

- Generator enclosures shelter critical assets from the elements

- Renowned Alternative Medicine Specialist Dr. Sebi and His African Bio Mineral Balance Therapy Are the Focus of New Book

- Psychiatric Drug Damage Ignored for Decades; CCHR Demands Federal Action

- Why Millions Are Losing Sexual Sensation, And Why It's Not Age, Hormones, or Desire

- Justin Jeansonne An Emerging Country Singer-Songwriter Music Fans Have Been Waiting For…a True Maverick

- Russellville Huntington Learning Center Expands Access to Literacy Support; Approved Provider Under Arkansas Department of Education

- UK Financial Ltd Launches U.S. Operations Following Delaware Approval

- The "Neutral" Lie:75-Year Construction Dynasty Exposes How Banks and Landlords Are Enforcing

- Pinealage: the app that turns strangers into meditation companions — in crowdfunding phase

- "Micro-Studio": Why San Diegans are Swapping Crowded Gyms for Private, One-on-One Training at Sweat Society

- Beycome Closes $2.5M Seed Round Led by InsurTech Fund

- Tru by Hilton Columbia South Opens to Guests