Trending...

- David Boland, Inc. Awarded $54.3M Construction Contract by U.S. Army Corps of Engineers, Savannah District

- Premium Bail Bonds Proudly Sponsors BOFAB BBQ Team at the 2026 Lakeland Pigfest

- UK Financial Ltd Receives Recognition In Platinum Crypto Academy's "Cryptonaire Weekly"

MADISON, Wis., June 16, 2021 /PRNewswire/ -- Despite challenges presented by the COVID-19 pandemic and resulting recession, the middle class is displaying heightened optimism and confidence in their financial security and retirement prospects – even though their savings remain strained, according to new survey data from CUNA Mutual Group.

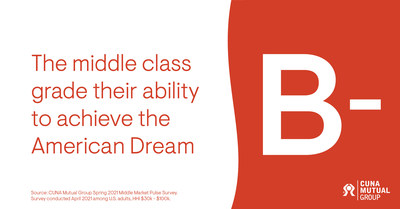

When asked to grade the middle class's ability to achieve the American Dream, respondents gave a B-minus, higher than March and May of 2020, when the average grade was a C-plus, as well as May 2019, when the average grade was a C. Further, confidence in their personal economic position has risen. Specifically:

Additionally, respondents revealed that although the COVID-19 pandemic had doled out a notable hit, the impact was perhaps not as much as anticipated a year ago:

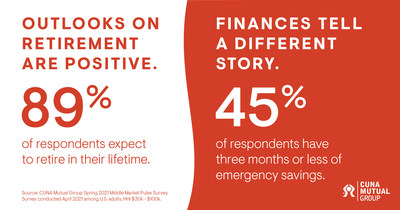

Importantly, however, even though the middle class is feeling more financially secure, their personal safety nets still tell a different story. Nearly half (45%) have only three months or less of emergency savings, which is in line with May 2020 (47%).

"While it's encouraging to see rising optimism among the middle class, especially after a year of unprecedented loss and financial difficulty, it's apparent that the gap between awareness and preparedness is growing only starker," said Paul Chong, senior vice president, CUNA Mutual Group. "This further underscores that the retirement crisis is still very real and stands to worsen coming out of the pandemic. I It's more important than ever for the financial services industry to focus on how to better address the long-term planning needs of all hardworking Americans."

More on Wisconsin Eagle

Reality bites, or the kids are alright?

Data also showed that Gen X was consistently more skeptical than other generational groups about their own financial prospects – but also on how much the pandemic has set them back – while the opposite phenomenon was reported by Gen Z. Specifically:

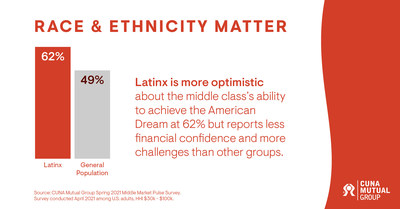

Latinx feels positive about the future of the middle class – but faces notable challenges in building financial security

The Latinx middle class – particularly Latinx women – are more optimistic about the middle class's ability to achieve the American Dream, but report less financial confidence and more challenges than other groups as a result of the COVID-19 pandemic. Of note:

"The disparities we're seeing among from the Latinx middle class on key indicators of financial stability is concerning, though unfortunately, not surprising given how widespread economic inequality has been – and continues to be – for communities of color," said Steve Rick, chief economist, CUNA Mutual Group. "Especially given how impacted the Latinx community has been by the COVID-19 pandemic, it is absolutely paramount that steps are taken holistically across our economy to not only bridge the K-shaped recovery that has started to emerge, but to ensure more equitable access to financial security for all in the future."

More on Wisconsin Eagle

Methodology

Based on findings from a general population survey conducted by ENGINE INSIGHTS on April 14-18, 2021, assessing 1,000 U.S. adults ages 18 or older and making an annual income between $35,000 and $99,999 – and an oversampling conducted April 19-22 surveying 800 Black and Hispanic men and women ages 18 or older and making an annual income between $35,000 and $99,999

About CUNA Mutual Group

Built on the principle of "people helping people," CUNA Mutual Group is a financially strong insurance, investment and financial services company that believes a brighter financial future should be accessible to everyone. Through our company culture, community engagement, and products and solutions, we are working to create a more equitable financial system that helps to improve the lives of those we serve and our society. For more information, visit www.cunamutual.com.

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Corporate Headquarters: 5910 Mineral Point Road, Madison WI 53701.

CORP-3619667.2-0621-0723

SOURCE CUNA Mutual Group

Related Links

www.cunamutual.com

When asked to grade the middle class's ability to achieve the American Dream, respondents gave a B-minus, higher than March and May of 2020, when the average grade was a C-plus, as well as May 2019, when the average grade was a C. Further, confidence in their personal economic position has risen. Specifically:

- 71% report feeling very or somewhat confident, higher than in March and May of 2020 (63%), as well as May 2019 (61%)

- Outlooks on retirement have also gotten more positive – 89% of respondents expect to retire in their lifetime, slightly up from the 87% reported in May 2020

- Those who expected to retire prior to turning 65 rose from 30% in May 2020, to 39% in April 2021

Additionally, respondents revealed that although the COVID-19 pandemic had doled out a notable hit, the impact was perhaps not as much as anticipated a year ago:

- More than half (57%) experienced setbacks as a result of the pandemic, with 35% reporting setbacks to their physical or mental health

- At the same time, 30% of respondents said the pandemic decreased their financial stability, down from 38% in May 2020

- Nearly three quarters (72%) said their job is equally or more stable than a year ago

Importantly, however, even though the middle class is feeling more financially secure, their personal safety nets still tell a different story. Nearly half (45%) have only three months or less of emergency savings, which is in line with May 2020 (47%).

"While it's encouraging to see rising optimism among the middle class, especially after a year of unprecedented loss and financial difficulty, it's apparent that the gap between awareness and preparedness is growing only starker," said Paul Chong, senior vice president, CUNA Mutual Group. "This further underscores that the retirement crisis is still very real and stands to worsen coming out of the pandemic. I It's more important than ever for the financial services industry to focus on how to better address the long-term planning needs of all hardworking Americans."

More on Wisconsin Eagle

- Peernovation 365 is Now Available

- Snap-a-Box Brings Texas' First Robot-Cooked Chinese Takeout to Katy–Fulshear

- UK Financial Ltd Makes History as MayaCat (SMCAT) Becomes the World's First Exchange-Traded ERC-3643 Security Token

- Kafka Granite Promotes Jason Chilson to Business Development Manager – Specialty Aggregates

- Narcissist Apocalypse Marks 7 Years as a Leading Narcissistic Abuse Podcast

Reality bites, or the kids are alright?

Data also showed that Gen X was consistently more skeptical than other generational groups about their own financial prospects – but also on how much the pandemic has set them back – while the opposite phenomenon was reported by Gen Z. Specifically:

| Gen X | Gen Z | Millennials | Baby Boomers | |

| % with three months or less in emergency savings | 65% | 35% | 48% | 35% |

| % feeling somewhat less or not very confident in their economic position | 44% | 20% | 24% | 26% |

| % experiencing setbacks as a result of the COVID-19 pandemic | 59% | 83% | 75% | 38% |

| % experiencing physical or mental health setbacks as a result of the pandemic | 38% | 47% | 45% | 25% |

| Plurality grade on the middle class's ability to achieve the American Dream | C | B | B | B |

Latinx feels positive about the future of the middle class – but faces notable challenges in building financial security

The Latinx middle class – particularly Latinx women – are more optimistic about the middle class's ability to achieve the American Dream, but report less financial confidence and more challenges than other groups as a result of the COVID-19 pandemic. Of note:

- 62% of Latinx respondents gave an A or B grade, higher than the general population (49%), led by Latinx women, who were the most positive out of all racial and gender demographic groups (65%).

- However, when asked about their personal ability to achieve the American Dream, Latinx women were notably lower compared to Latinx men (66% versus 71%).

- However, Latinx respondents were the most likely to report experiencing setbacks from the pandemic (80% vs. 57% of the general population), with over half (51%) saying they experienced setbacks to their mental or physical health – notably more than the general population (35%).

- Latinx fared the worst out of all racial demographic groups on emergency savings – 50% reported having three months or less, compared to 45% of the general population, led by 53% of Latinx women.

"The disparities we're seeing among from the Latinx middle class on key indicators of financial stability is concerning, though unfortunately, not surprising given how widespread economic inequality has been – and continues to be – for communities of color," said Steve Rick, chief economist, CUNA Mutual Group. "Especially given how impacted the Latinx community has been by the COVID-19 pandemic, it is absolutely paramount that steps are taken holistically across our economy to not only bridge the K-shaped recovery that has started to emerge, but to ensure more equitable access to financial security for all in the future."

More on Wisconsin Eagle

- High-Impact Mental Health Platform Approaching a Defining Regulatory Moment: Eclipsing 70,000 Patients on Real World Use of Ketamine: N ASDAQ: NRXP

- CryptaBox Introduces a Hardware Crypto Cold Storage Wallet

- When The Call Hits Home Kicks Off 2026 with a Powerful Conversation on Trauma and Growth

- YWWSDC Launches AI-Native Digital Asset Infrastructure, Merging Technical Innovation with US-Standard Compliance

- High-End Exterior House Painting in Boulder, Colorado

Methodology

Based on findings from a general population survey conducted by ENGINE INSIGHTS on April 14-18, 2021, assessing 1,000 U.S. adults ages 18 or older and making an annual income between $35,000 and $99,999 – and an oversampling conducted April 19-22 surveying 800 Black and Hispanic men and women ages 18 or older and making an annual income between $35,000 and $99,999

About CUNA Mutual Group

Built on the principle of "people helping people," CUNA Mutual Group is a financially strong insurance, investment and financial services company that believes a brighter financial future should be accessible to everyone. Through our company culture, community engagement, and products and solutions, we are working to create a more equitable financial system that helps to improve the lives of those we serve and our society. For more information, visit www.cunamutual.com.

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Corporate Headquarters: 5910 Mineral Point Road, Madison WI 53701.

CORP-3619667.2-0621-0723

SOURCE CUNA Mutual Group

Related Links

www.cunamutual.com

0 Comments

Latest on Wisconsin Eagle

- Biz Hub Financial Hosts 9th Annual Client Appreciation Event, Awards $1,000 CARES Community Grant

- Green Office Partner Appoints Aaron Smith as Chief Revenue and Growth Officer

- A Family Completes a Full Circumnavigation of the Globe in a Self-Contained Camper Van

- Lovers Unite Onstage For A Valentine's Affair 2026

- Former Google Search Team Member Launches AI-Powered SEO Consultancy in Las Vegas

- Q3 2025 Arizona Technology Industry Impact Report Highlights Shifting Job Demand, Semiconductor Momentum and Workforce Investment

- $6.4 Million Purchase of Construction Vehicles Plus New Dealership Agreement with Cycle & Carriage for Heavy Equipment Provider to Singapore Region

- Acmeware and Avo Partner to Bring Real-Time Data Integration to MEDITECH Customers

- CCHR Says Mounting Evidence of Persistent Sexual Dysfunction From Antidepressants Demands FDA Action

- New Analysis Reveals Most Patients Discontinue Weight Loss Drugs Within First Year

- International Law Group Expands Emergency Immigration Consultations for Somali Minnesotans Amid ICE Actions

- Premium Bail Bonds Proudly Sponsors BOFAB BBQ Team at the 2026 Lakeland Pigfest

- Important Information - Improving Sustainability - Efficiency - Reduce Maintenance - ECOFUELMAX

- UK Financial Ltd Receives Recognition In Platinum Crypto Academy's "Cryptonaire Weekly"

- P-Wave Press Announces Pushing the Wave 2024 by L.A. Davenport

- Preston Dermatology & Skin Surgery Center Wins Gold and Bronze in Prestigious Annual DIAMOND Awards

- David Boland, Inc. Awarded $54.3M Construction Contract by U.S. Army Corps of Engineers, Savannah District

- "Phinge Unveil™" Coming to Las Vegas to Showcase Netverse Patented Verified App-less Platform, AI & Modular Hardware Including Developer Conferences

- Elizabeth McLaughlin, Founder and CEO of Red Wagon Group, named 2026 Presidential Leadership Scholar

- U.S. Congressional Candidate Peter Coe Verbica on America's Asymmetric Crisis